On-Demand Manufacturing Firm Fictiv Expands to China

Fictiv publishes results from its poll with hardware manufacturers (clock for larger image).

Latest in Rapid Prototyping and Manufacturing Services

Rapid Prototyping and Manufacturing Services Resources

Latest News

September 7, 2018

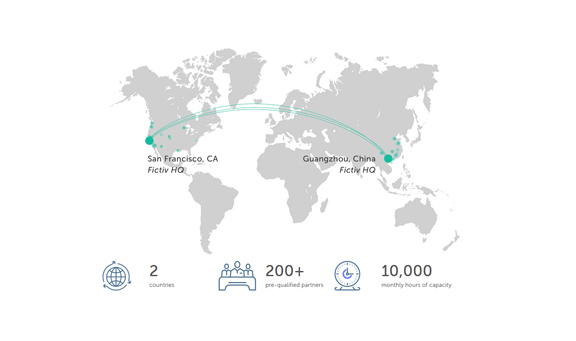

Recently, San Francisco-headquartered manufacturing startup Fictiv opened a new headquarter in Guangzhou, China, signalling its overseas expansion.

In June, the company launched Agile Manufacturing Solution (AMS), described as “a suite of production manufacturing services for supply chain and engineering teams who need fast, quality end-use parts at high volumes of 100 - 500,000 units.”

When the Fictiv first opened its doors two years ago, it operated with a provider network comprising U.S. machine shops. The new AMS is run with service teams based in both U.S. and China, Fictiv states. The network now includes 30-50% overseas partners, according to Dave Evans, Fictiv's CEO and cofounder.

Fictiv exemplifies a growing pool of on-demand manufacturing service providers, characterized by web-based job submission, instant (or near-instant) price quote, and quick turnaround. They fill a need especially for the inventors, designers, markers, and hardware startups that don't have their own production capacity.

With the launch of its China-based operations, the company offers users more manufacturing choices. Some of these choices may be tempered by the growing tension between U.S. and China. and the desire for local production due to speed.

On-Demand Manufacturing

Firms like Fictiv offer value as a convenient single-source portal to order parts from a trusted pool of providers, eliminating the need for businesses to individually investigate local and overseas machine shops to identify the most suitable partners.

Fictiv's services include CNC (machining) and 3D printing. Also in the same market are Xometry, which recently acquired the smaller firm MakeTime; Plethora, an on-demand CNC machine shop; and Protolabs, which offers 3D printing as well as machining services. A slice of the market is also served by the on-demand production divisions of 3D printer makers 3D Systems (branded QuickParts) and Stratasys.

For individual design shops and small manufacturers, seeking an overseas partner or supplier also comes with the burden to ensure compliance and conduct due diligence.

China-based Fictiv division is led by “a team of seasoned manufacturing experts who serve as an extension of our customer's supply chain teams,” says Evans. “Fictiv employees in China HQ inspect and onboard manufacturing partners, work directly with customers to ensure design requirements are clearly communicated, and are on the factory floor during production to ensure things are running smoothly. In addition, Fictiv requires all of its manufacturing partners (in the U.S. and overseas) to complete quality checks with documentation for every order. Finally, Fictiv has its own Quality Assurance team, which analyzes parts and does quality checks before parts are shipped to the customer.”

The Fictiv Hardware Report

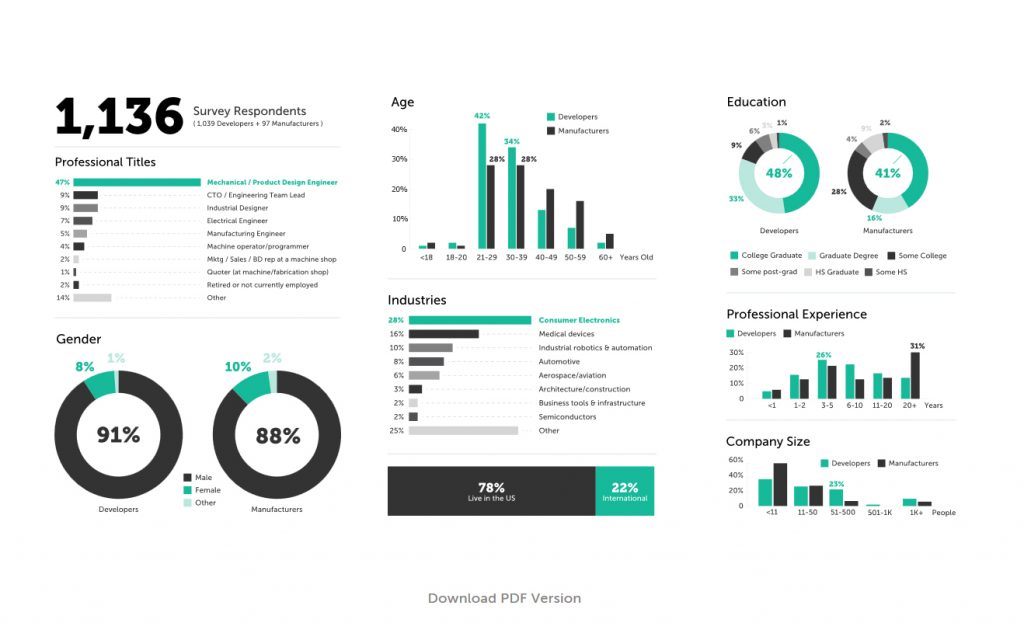

In June, Fictiv published a report titled “2018 State of Hardware” based on a poll conducted with “1,136 developers and manufacturers spanning 72 industries.” According to its findings, “71% of developers use external shops in development, with 36% exclusively using external.”

The company also notes in the report that, “Despite challenges, development teams rely on local suppliers more than ever, likely because of fast delivery times.” Nearly half of the developers polled (49%) say their external vendors are “often or always local.”

“While overseas pricing traditionally provides a cost advantage over local manufacturers, Fictiv aggregates demand from many customers to secure cost-competitive pricing with all of its manufacturing partners—much more so than a company would receive just getting a quotes by themselves from a local supplier,” Evans points out. “Using the Fictiv platform allows customers have the option of producing parts overseas or locally, based on their requirements for schedule, price and quality.”

Effects of New Tariffs

According to Financial Times, “$200bn worth of goods, ranging from auto parts to food ingredients to construction material” are expected to be hit by the new tariffs, raising concerns of production costs and price increases.

Venture capital-driven Hardware accelerator HAX straddles Shenzhen and San Francisco, with design projects that draw resources from both. “A startup does not have the power to create an ecosystem around it or build its own factories,” notes Cyril Ebersweiler, cofounder of HAX. “What U.S. startups are looking for in China is a full-blended ecosystem which supports their development from prototyping to scaled-up manufacturing. Plus, service will always be cheaper in China because of the scale of the supply chain.”

Duncan Turner, managing director of HAX, thinks, “Production costs should not increase due to tariffs. If anything they may decrease a little as competition will drive margins down a little. Cost of goods landed will be significantly higher though.”

Applied Motion Products, a standard component supplier, sent a notice to its customers in July. “We do not want to raise prices on any of our products ... However, we cannot completely absorb the increased tariff burden and still hope to maintain inventory levels at optimum levels ... Effective July 16th, 2018, Applied Motion will apply a 15% surcharge to all products affected by the new tariffs,” it reads.

“Fictiv has seen incredible response to the launch of the AMS product, despite the tariff escalation,” notes Evans. “We believe, in order for companies to remain competitive in today's political environment, they have to invest in manufacturing supply with the agility to quickly respond to disruptions—including tariffs, material shortages, and even extreme weather. Agile manufacturing means being able to spin up new production instances quickly, limiting the risk a customer has with a single manufacturer.”

HAX executives raise concerns for the IOT commerce related to connected devices. “Hardware enabled tech companies don’t make money on hardware. They rely on cheap manufacturing to push tech into business and daily lives. They then monetize their business through recurring revenue and software subscription (which all stays in the U.S.) ... These tariffs make everyone lose. With respect to tech companies enabled on hardware, they will be hit hard as they will have to charge more or lose more on their enabling hardware,” says Turner.

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Kenneth Wong is Digital Engineering’s resident blogger and senior editor. Email him at [email protected] or share your thoughts on this article at digitaleng.news/facebook.

Follow DE