History of Mechanical Computer Aided Design: Where Have We Been?

Part 1: The last few decades of design solutions in the mechanical, software engineering, and electronic design automation industries owe their success to impressive creativity and enthusiasm.

Latest News

November 1, 2008

By Allan Behrens

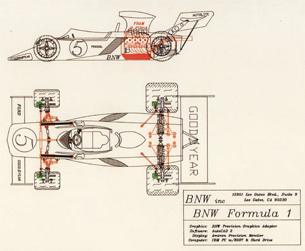

This is an AutoCAD 2 drawing of a Ford F1 circa 1985. (Image courtesy of Autodesk) |

Looking back over the last 35 years of mechanical design, you can’t fail to be anything but impressed with the creativity and enthusiasm that’s driven design solutions in the mechanical, software engineering, and electronic design automation (EDA) industries.

The Seventies

By 1971 the mechanical CAD market was an established industry. Leading companies included Auto-trol, Computervision (acquired by PTC in 1998), Structural Dynamics Research Corp. (SDRC, acquired by UGS in 2001), the McAuto division of McDonnell-Douglas, and United Computing (now Siemens PLM Software). In general, however, MCAD products were unwieldy and expensive, and the computers and displays required to run the latest design software limited access to all but the largest companies.

Generally, CAD tools duplicated the paper tasks of human operators. They automated laborious processes to produce clearer paperwork, with additional time-saving features such as automatic dimensioning and the ability to easily and quickly modify drawings.

Design as an intellectual activity was supported by many CAD operators (evolved from draftspeople) who took conceptual paper sketches and mockups and translated them into computer-based MCAD files. These were then output as printed paper drawings of parts and assemblies. Once designs were complete they were passed to purchasing, production, and manufacturing, which were often located within the same building or at least on the same site. Essentially a local serial workflow.

From 2D to 3D with AutoCAD in the 1980s. (Image courtesy of Autodesk) |

In 1971, Intel Corporation launched the 4004 microprocessor, widely recognized as the first single-chip computer and arguably the starting point of the PC revolution. While the 4004 did not launch a new wave of design technologies, it heralded a change of monumental computing proportions through the 1980s and 1990s that affected the entire software market, none more notably than mechanical CAD.

Also of particular note in the 1970s, Avion’s Marcel Dassault purchased a program called CADAM (Computer-Augmented Drafting and Manufacturing) from Lockheed in the U.S. and progressed during the next decade to launch CATIA (computer-aided three-dimensional interactive application). Many applications at the time were proprietary to each major OEM and the emergence of applications such as CATIA signaled a change in the process for the development of MCAD applications. Large OEMs continued (and some of them still continue) to develop applications to maintain specific aspects of product and process differentiation.

Competition and time to market fueled demand. The focus was to reduce design cycle times, and in particular to improve the productivity of each user. This in turn fueled the need for more raw processing and graphics power. We saw an expansion in the mechanical design software market from an estimated $25 million in 1970 to more than $1 billion in 1980, driven principally by increased demand from the then-affluent automotive and aerospace companies. Software that historically ran on dedicated computers and mainframes became readily available on lower-priced minicomputers. And this drove down prices.

Early version of Autodesk Designer. (Image courtesy of David Weisberg) |

The Eighties

In the 1980s, two major trends appeared. The first was the rapid proliferation of personal computers as pioneered by IBM. The second was the move from simple drafting task automation (2D) to a more widespread use of 3D and indeed to begin the era of “concurrent engineering” where the emphasis was on decreasing time to market by increasing the parallel nature of development tasks. Concurrent engineering effectively took what was a predominantly sequential set of design and engineering processes and attempted to parallelize them.

The advent of the PC was instrumental in moving the MCAD market to the masses, and the software vehicle that first delivered on this promise was AutoCAD from Autodesk. In 1982, AutoCAD was launched with the maxim that users got “80 percent of the functionality of mainframe software at 20 percent of the price.” It took the 2D world by storm. It was not only a good drafting tool, but it allowed third-party developers to add applications to the core software, thereby creating added customer value and a powerful community of second-tier suppliers and products emerged.

As the 2D market evolved, so too did 3D. And its evolution was matched with advances in workstation platforms and the underlying mathematical methods to create and define the models. 3D demanded even more processor power per user, which in turn drove developments in both graphics and processor design. The era of the personal workstation was born and the market saw dramatic growth in upstart computer companies like Sun, Apollo, and SGI (previously Silicon Graphics). Established computer vendors including HP, Digital, and IBM struggled to maintain pace with new “open systems” upstarts.

Trunk exterior toolpaths created directly from math data by Patrick Hanratty for GMaround 1966.(Image courtesy of David Weisberg) |

At the time, the constraint on the 3D market was not so much the concept and benefits of designing in 3D, but more its ease of use and cost.

Change came in 1987 when Parametric Technology Corp. (PTC) launched its parametric 3D design application Pro/ENGINEER. The revolutionary and easy to operate “2½D paradigm,” slick user interface, and productive modeling techniques (although pioneered by Evan Sutherland some 20 years earlier) took the market by storm.

Leading vendors struggled to rationalize their products in response to Pro/ENGINEER. Eventually, most 3D products evolved to contain elements of parametric constraints, history-based design concepts, and (at the time X-Windows-based) context-sensitive menus.

The Nineties

On entering the 1990s, Dassault Systèmes (with its IBM sales partner), Unigraphics, SDRC, and Parametric Technology Corp. were clear leaders in many corporate accounts. Customers were looking to move to an all-3D digital product design concept pioneered, on the whole, by large companies such as Boeing and General Motors. Within this concept, software vendors focused on improvements in the quality, accuracy, speed, and concurrency within customer design teams as well as improved manufacturability.

Long-time contenders such as Computervision and Intergraph suffered from the market’s perceived view that their products were “proprietary” (including hardware), and because of the growing momentum to use more open-systems environments.

As the “new order” settled, SolidWorks, a startup 3D CAD company, launched its SolidWorks 95 3D application on a PC platform using the mantra “80 percent of Pro/ENGINEER’s functionality at 20 percent of the price.” (It was remarkably similar to Autodesk’s original credo). The company set out to redefine the mass use of 3D mechanical design as Autodesk did a decade before for 2D.

AutoShade was available with AutoCAD R10. (Image courtesy of Autodesk) |

Though the move to 3D is still considered too complex (in some cases too painful) by many, most believe that the market has moved on through the “missionary” stage to generally embrace the 3D paradigm. The move from drawing board to 2D CAD was an evolutionary process that demonstrated direct productivity gains. The benefits in the move from 2D to 3D have not, however, proven as simple or as measurable. Many of the benefits of working in the 3D world required substantial working practice and business process change. To many, the benefits derived were seen as being constrained by lack of imagination, software capability (possibly user interface), complexity, and costs. In many cases, personal agendas were among the biggest hurdles to implementation.

Business Models for A New Millennium

Into the new millennium, the need for better quality, more speed, cheaper systems, and more complexity must be examined within the context of rapidly changing business models. For example, in the 1990s collaboration among numerous internal stakeholders was a significant problem. Today, concurrency must be achieved with disparate global networks of individuals, locations, and companies; each of which is expected to bring value to the product or design.

As for the near term, there appear to be trends in two main areas.

The first is to enable you to do more with the design (information) using less effort. This would include better tools to enable more comprehensive “virtual product” creation and testing. One challenge here is that the design activities of mechanical, electrical, electronic, and software teams are still “siloed.”

The second trend focuses on developing values that affect a broader set of business issues. Design is just one of the many challenges when asking questions like: What products should we make, how can we make them, support, and dispose of them better? Could we refine our business workflow and manage interaction in a dispersed community? How can we differentiate on something other than price? These are elements of the vision often referred to as product lifecycle management (PLM). Some believe this is applicable only to larger companies. In reality it affects most businesses, but to differing extents.

The challenge to the likes of Dassault Systemes, Siemens PLM Software, PTC, Oracle/Agile, and more recently Autodesk is how to enable the PLM concept for the masses, not just the major corporations.

The Million-Dollar Question

If we look at past cycles in the CAD market over the last three and a half decades, there appear to be two principal topics that have delivered the next big thing:

- A step change in usability (in fact it’s simpler to use and apply) to deliver appeal beyond larger companies to the masses.

- A step change in price-performance for what was considered as the most common (80 percent) functionality.

The million-dollar question is, who’ll be the first to force the next change? Will it be based on one of the topics above? Will it be an established player or a new entrant? Whatever the case, from many peoples’ reckoning, the next big thing in MCAD appears to be somewhat overdue.

More Info:

Autodesk

San Rafael, CA

Auto-trol Technology

Denver, CO

Boeing

Chicago, IL

Dassault Systèmes

Paris, France

GM

Detroit, MI

HP

Palo Alto, CA

IBM

Armonk, NY

Intel

Santa Clara, CA

Oracle/Agile

Redwood Shores, CA

PTC

Needham, MA

SGI

Sunnyvale, CA

sgi.com

Siemens PLM Software

Plano, TX

SolidWorks

Concord, MA

Sun Microsystems, Inc.

Santa Clara, CA

Allan Behrens is the director of Cambashi Ltd., UK-based analysts and consultants on the effective use of IT in industry. He can be reached at [email protected]. Send comments about this article via e-mail sent to [email protected].

The editors wish to thank David Weisberg of Cyon Research for images from his book, “The Engineering Design Revolution: The People, Companies and Computer Systems That Changed Forever the Practice of Engineering.” For more info, visit cadhistory.net or cyonresearch.com.

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

DE’s editors contribute news and new product announcements to Digital Engineering.

Press releases may be sent to them via [email protected].