All Signs Point to Maturing AM Market

AM technology is finally primed for production-grade parts while new software enables more seamless design-to-print workflows.

Autodesk Fusion 360 was used to design and 3D print an intake manifold and turbo plumbing set up for BBi Autosport. Image courtesy of Autodesk.

December 6, 2023

Call it a level set or maturation of a market. While consolidation and slowing capital infusion have impacted the additive manufacturing (AM) space this year, many bright spots remain, including significant progress on production-scale 3D printing applications as well as technology enhancements that make it easier to support end-to-end, design-to-3D print workflows.

After years of hype, 3D printing, especially metal AM technology, is increasingly being tapped for production of end-use parts across various industry sectors. Oil & gas and aerospace & defense companies are leveraging capabilities of 3D printing technologies to produce the intricate conformal channels used in heat exchangers, to lightweight turbine blades and to design and build engine components. Medical device manufacturers are moving ahead with 3D printed custom prosthetics and surgical guides while specialized players in the orthodontics space are pioneering partnerships around custom 3D printing systems to churn out the personalized aligners used in treatment plans.

Availability of new production-grade AM materials, advances in software supporting design for AM (DfAM) and print preparation workflows, and the industrialization of 3D printing hardware are coming into alignment as the market continued to mature this past year.

“There are these magical moments in the history of engineering when tools and processes line up together and produce immense amounts of innovation, and we’re in that now,” says Bradley Rothenberg, CEO and founder of nTopology. “Better tools, better materials that are qualified, better hardware that’s repeatable—everything is lining up and we’re seeing an incredible amount of innovation on the ground at customer sites now.”

In a presentation highlighting key takeaways for 3D printing in 2023, IDTechEx called out the momentum of AM growing into important high-value applications, particularly among prominent companies. Tesla, for example, is pioneering a process called “gigacasting,” where it’s employing sand binder jetting technology for molding the front and rear portions of its Model Y vehicle as part of a move to slash production costs, according to Sona Dadhania, IDTechEx senior technology analyst.

For its part, Apple is testing the use of binder jetting metal 3D printers to create the steel chassis in an Apple Watch Series 9 model to use less material and be more eco-friendly than components made with traditional CNC milling, Bloomberg reports.

Both commitments are important indicators that 3D printing is finally gaining traction for end use, higher volume production parts, Dadhania says. “It’s a golden area for 3D printing to achieve higher value, and we’ll see more of it next year,” Dadhania says. Despite some market slowdown, IDTechEx expects the 3D printing market to be on track to grow to $41 billion by 2033, according to recent estimates.

Dadhania called out other signs of continued AM momentum. 3D printing is increasingly being leveraged to build agile, robust supply chains—a trend that picked up significantly in the aftermath of the pandemic to drive more flexibility and to keep production domestic, she says. IDTechEx is also seeing a spike in use of 3D printing for on-demand, on-site production of spare parts, particularly in military applications and in the oil & gas industry, she says, in addition to companies making progress on AM economics.

“Companies are finding the sweet spot for certain applications, where the geometry or volume is well-suited for AM more so than traditional manufacturing,” Dadhania says. “These will help bolster growth in 3D printing.”

Industrialization of AM

Thanks to breakthroughs enabling the introduction of large-format systems, new alloys and other materials advances, and improvements to quality control capabilities, companies have made notable headway over the last 12 to 18 months by making large, complex end-use parts.

Larger format printers such as the Velo3D Sapphire XC are improving the manufacturing time and economics of metal 3D printing. Image courtesy of Velo3D.

On the metals 3D printing front, new systems featuring multiple lasers working in concert are enabling production of parts that previously weren’t possible to 3D print, including structural components for jet and rocket engines as well as parts for compressors and other components used in large-scale wind turbines.

“People limited their imagination about the maximum size parts they could make and now we’re breaking away from those limits,” says Benny Buller, founder and CEO of Velo3D, a manufacturer of fully integrated metal AM solutions. “Now, they’re imaging very large parts made with an enormous amount of lasers available in very large systems. That’s a big breakthrough over the last year or two.”

In addition to wider availability of large-format 3D printers, advances such as the ability to leverage sensor data for improved process control will continue to move the needle on production-scale AM.

3D printers are incorporating greater numbers of sensors to collect data at every step of the print process. That data, coupled with analytics and artificial capabilities, enables insights that can be used to create recipes and instructions that predict problems, tighten controls and help reduce the variability of parts, Buller explains. Eventually, the combination of data and AI will support new in-situ monitoring capabilities that track the print process, predict points of failure and make on-the-fly adjustments to address printing and quality issues.

“The next phase will be more and more use of AI to interpret this data and create control algorithms and policies that narrow down the distribution of material on parts we’re making,” Buller explains. “When you are making parts for mission-critical applications, variability is the enemy of quality.”

Integrating print preparation and build simulation into an end-to-end AM print and design workflow is also important to generating quality 3D printed parts at scale. Here, too, companies are starting to deliver. Providers like Siemens Digital Industries Software are building software functionality that allows companies to simulate orientation of parts in the build tray or to simulate the powder bed print process to identify areas that might result in part distortion or recoater collisions.

Materialise’s ongoing focus on enhancing process and quality control involves bringing light to the AM black box. To that end, the company has recently enhanced its CO-AM cloud-based software platform for scaling AM workflows with the CO-AM Quality & Process (QPC) system. The new system tracks, monitors, analyzes and correlates all data critical to part quality such as 3D models, materials and process parameters. The QPC Layer Analysis, one module in the platform, has been further developed to include more in-situ process monitoring data sources and to correlate results with computed tomography scans—another effort to boost consistent quality for certified manufacturing.

Beyond making AM quality processes as efficient as possible, an integrated platform like CO-AM helps create a knowledge base of AM best practices and expertise, which is important at a time when skilled AM practitioners are still hard to come by.

“By capturing data in a structured way, manufacturing engineers and other users can learn from it and leverage the data to create the secret sauce that brings a competitive edge,” notes Bryan Crutchfield, vice president and general manager for North America, at Materialise.

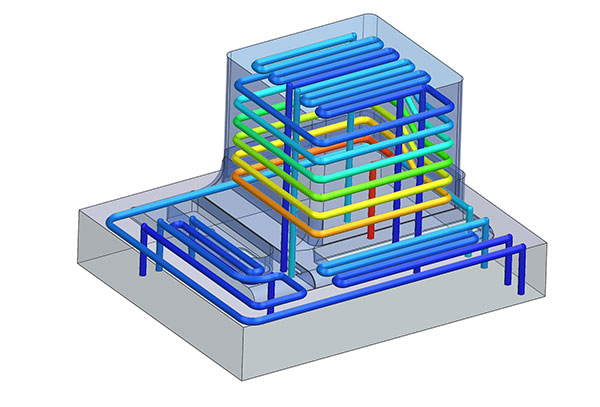

Advances in design for AM and simulation capabilities now enable mold inserts with conformal cooling channels to be 3D printed. Image courtesy of Siemens Digital Industries Software.

Accessible Design for AM

As companies move from prototyping to full-scale production with AM, it’s been widely recognized that parts need to be reimagined to take advantage of AM’s unique capabilities for lightweighting and producing organic shapes not possible with conventional manufacturing methods.

Vendors are aiming to make DfAM more accessible to a wider audience, in some cases even eliminating constraints on the hardware side such as minimizing the number of supports necessary or providing more controls and flexibility on the build plate. On the software side, there’s a lot happening, such as melding DfAM capabilities into mainstream design engineering platforms like CAD tools, as well as the introduction of generative design and topology optimization capabilities that make it easier to create complex geometries and lattice structures tuned for 3D printing.

Siemens, for example, is building much of this functionality into NX to make it easier for designers to create designs that are consistently validated for output with 3D printing processes. For example, NX incorporates functions such as Mold Wizard, which allows designers to develop high-quality molds with associativity to part designs for AM as well as more conventional manufacturing processes.

“There’s an advantage to having an integrated system with capabilities like topology optimization and the ability to build lattice structures,” says Ashley Eckhoff, advanced product manager for AM, at Siemens. “When you’re designing medical or aerospace parts where the design and manufacturing of a part is tightly controlled, it’s important to maintain control of that data throughout the entire process.”

Autodesk is also a believer in an integrated design and manufacturing platform advancing AM for large-scale production. For example, the Fusion 360 platform reimagines the experience, allowing designers to make changes to overhangs, move supports or modify wall thickness to improve manufacturability in a single design platform without the need for managing different versions or swapping STL files between software applications, notes Alexander Oster, directive of additive manufacturing for Autodesk. Autodesk’s data model, at the heart of the Fusion platform, ensures that changes made in one workflow are automatically and instantly reflected everywhere so everyone is working on the most current model.

“When you have all the downstream processes in the same product, it’s much easier because you can do all the data preparation during the design process,” he says. “The best way to design from AM from the get-go is to put all the manufacturing technology directly in the CAD environment because it allows you to do so in a parametric way. It’s a more agile way of designing products.”

Streamlined design-to-print workflows, the emergence of low-cost scanners, easier point cloud acquisition capabilities and the emergence of AI will continue to drive use of AM for personalized products. Consumer products like sneakers and sporting goods as well as medical devices like custom orthotics and prosthetics will continue to reap the rewards of more accessible 3D printing, according to Arvind Rangarajan, global head of software and data for HP’s personalization and 3D printing business.

“AI has the opportunity to make a big impact, making personalization, customization and high-performance design simpler,” Rangarajan says. “It will really move AM into the true production-scale applications we all aspire to have.”

As AM continues to mature, it’s now at an inflection point where companies are looking for efficiency and value—not just for experimentation or the cool factor of prototyping with AM. “You can’t 3D print just to 3D print anymore—you need to 3D print for a reason,” says Autodesk’s Oster. “Now it’s about unlocking value through use of 3D printing or to make a difference in existing processes.”

More Autodesk Coverage

More Hewlett Packard Coverage

More Materialise Coverage

Subscribe to our FREE magazine, FREE email newsletters or both!

About the Author

Beth Stackpole is a contributing editor to Digital Engineering. Send e-mail about this article to [email protected].

Follow DE