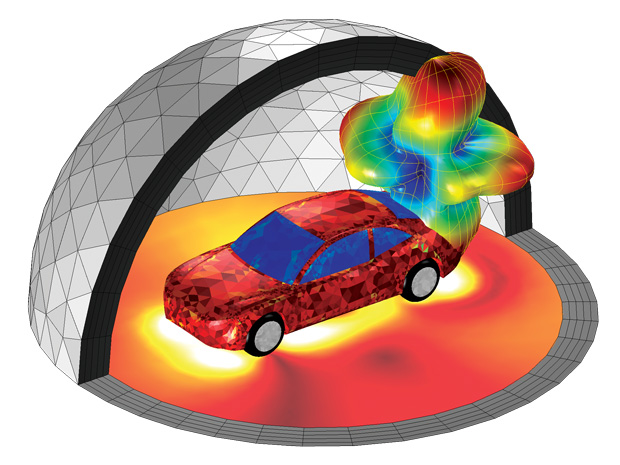

Numerical simulation of an FM antenna printed on the rear windshield of a vehicle. The far-field radiation pattern of the antenna is shown, as analyzed with COMSOL Multiphysics software. Image courtesy of COMSOL.

Latest News

November 1, 2016

Think about the most complicated systems and structures on earth (and above). What comes to mind? The Three Gorges Dam? The Large Hadron Collider? The Space Shuttle or International Space Station? Now think instead about the car in your garage—or the one that will be there in a few years.

Numerical simulation of an FM antenna printed on the rear windshield of a vehicle. The far-field radiation pattern of the antenna is shown, as analyzed with COMSOL Multiphysics software. Image courtesy of COMSOL.

Numerical simulation of an FM antenna printed on the rear windshield of a vehicle. The far-field radiation pattern of the antenna is shown, as analyzed with COMSOL Multiphysics software. Image courtesy of COMSOL.Automotive design encompasses some of the biggest technical challenges engineers have faced in the past 50 years, as vehicles have progressed from being mostly mechanical to electromechanical, to increasingly smart—including the many flavors of autonomous. In parallel with these changes, developers of simulation software have been refining their products. DE asked a number of these companies for their perspective on managing the complex, large-scale system designs that are rapidly becoming standard in the automotive world.

An Automotive Smartphone on Wheels

For more than 100 years, successful automotive designs have relied, for the most part, on classic engineering: Knowledge of mechanical behavior, material properties and electrical and hydraulic systems. The push for compressed design cycles slowly added computer simulations of engines, powertrains and aerodynamic responses to the required skill set, followed by increased use of multiphysics and multi-domain analyses. And yet the challenges continue to change, making us wonder: Are we even still talking about designing cars?

“The increased requirements of cars equipped with cameras, sensors, touchscreens, computers and other electronics effectively turns modern cars into large smartphones,” Says Bjorn Sjodin, vice president of Product Management at COMSOL.

The implication, he notes, is that the automotive industry keeps getting new sets of simulation requirements, some of which are similar (or identical to) those for consumer electronics; automakers now compete with consumer-electronics companies for their workforce.

Other factors broadening the scope of automotive simulation requirements, says Sjodin, include the development of non-combustion-engine vehicles. While use of composite materials has greatly improved fuel efficiency, the push for better batteries, fuel cells, supercapacitors and wireless power transfer systems calls for a new breed of engineer experienced with electrochemistry and/or power electronics—plus the right sort of software tools .

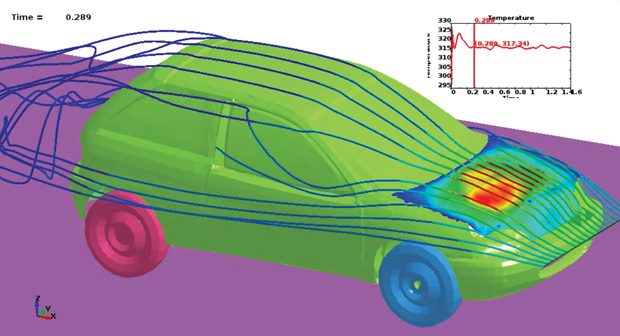

Structural, thermal, CFD and radiation simulations coupled in a single LS-DYNA vehicle analysis by Livermore Software Technology Corporation (LSTC) are pictured. The process involves solving for both the temperature distribution and structural vibration of the hood. The hood is heated up by the engine but also cooled by airflow; hood vibration is due to airflow over the vehicle. Image courtesy of LSTC.

Structural, thermal, CFD and radiation simulations coupled in a single LS-DYNA vehicle analysis by Livermore Software Technology Corporation (LSTC) are pictured. The process involves solving for both the temperature distribution and structural vibration of the hood. The hood is heated up by the engine but also cooled by airflow; hood vibration is due to airflow over the vehicle. Image courtesy of LSTC.The COMSOL Multiphysics software family addresses these needs by adding ever more simulation functions to its Application Modules, such as the RF Module that assists with simulating and analyzing rear-windshield antenna performance, and the Batteries & Fuel Cells Module that helps designers create energy-optimized cells for hybrid-electric vehicles.

With tomorrow’s vehicles involving so many multiphysics, multi-domain components and systems, another simulation company, Livermore Software Technology Corporation (LSTC), is expanding its high-end simulation package LS-DYNA. This non-linear transient dynamic FEA (finite element analysis) code now offers three new multiphysics solvers that handle incompressible CFD (computational fluid dynamics), compressible CFD/chemistry and electromagnetics. Such capabilities help designers evaluate the functions of traditional-fuel, hybrid-electric or all-electric vehicle designs as well as mechanical structures, with a focus on crash-worthiness.CAE simulations need to have a high level of predictability if CAE is to replace physical testing. Dilip Bhalsod, LSTC Michigan technical manager, says the automotive industry has been increasingly replacing physical testing with CAE simulations over the last 30 years, since the level of details in crash models have evolved to close the gap between CAE and physical testing. For LSTC, this includes developing new models for airbag deployment, ultra-high-strength steel, composite and plastic materials, spot-weld failure and other new material-joining methods employed in today’s vehicles. Accurate modeling in all of these areas is the key toward virtual validation of designs and reduced design cycle time.

With more active safety features introduced into today’s vehicles, LSTC is also developing capabilities to help customers simulate and design the sensors, control systems and actuators. For simulating these complex automotive subsystems, Bhalsod sees software development in need of a new single-code philosophy. He explains: “Although most companies use a single CAD software program, downstream the piece that is consuming a lot of effort and time is the use of multi-solvers handling different disciplines like crash, NVH [noise, vibration and harshness, and] durability,” he says. “There is a need for simulation software that can unify all of this.” With the trend to model globalization (i.e., addressing different regulations for each country) and the desire to compress design cycles to even 12 months, such streamlining would make companies much more competitive.

Dassault Systèmes, with its 3DEXPERIENCE platform, has a decades-long presence across the spectrum of automotive design, simulation and testing, and keeps expanding its offerings. Familiar technical solutions include the CATIA family of high-end 3D CAD design tools, SIMULIA Abaqus multiphysics simulation software, DELMIA products for virtual production and ENOVIA tools for global collaborative lifecycle management. Used together, these packages form a strong basis for developing tomorrow’s smart and autonomous vehicles.

Dassault Systèmes software products such as CATIA, SIMULIA and Dymola support multiphysics, multi-discipline and control-system design and simulation. Image courtesy of Dassault Systèmes.

Dassault Systèmes software products such as CATIA, SIMULIA and Dymola support multiphysics, multi-discipline and control-system design and simulation. Image courtesy of Dassault Systèmes.Along the way, Dassault Systèmes has recognized the value of working with model-based design technology to create optimal components, subsystems and highly connected vehicles. The company acquired Dynasim’s Modelica-based modeling and simulation solutions as well as Geensoft, with its tools to generate embedded code directly from the Modelica language. (The Modelica object-oriented language lets users model complex physical systems). Then last year, it also brought on Modelon GmbH, whose multiphysics, model-based systems portfolio helps users incorporate functional mock-ups (FMUs) for electrical and mechatronic subsystem design and analysis. To offer full digital continuity from concept to compliance, Dassault Systèmes now brings these products together in what it calls the “Smart, Safe and Connected” transportation/mobility industry solution based on the 3DEXPERIENCE platform.

Autonomous Vehicles Moving Ahead

In the past, automotive design was all about structure and mechatronics, and design engineering companies such as Altair focused on adding innovation and optimizing geometry. Altair (through its solidThinking division) recently introduced software products that now support the full spread of concept studies, control design, system performance optimization and controller implementation/testing. Michael Hoffmann, senior vice president for Math and Systems explains this shift in thinking that supports the increasing complexity of automotive design.

“We have done more than add functions,” notes Hoffmann. “In solidThinking we have added three new products: Compose, Activate and Embed. In the past, Altair did not offer a lot for electrical engineering—now, with the hot topic of autonomous vehicles, the value added moves away from structures to silicon, electronics and software. We needed to address this, so the products are all based on model-based development of mechatronic systems.”

Hoffmann says that the new offerings give users a number of options. “People can do conceptual modeling with abstract models, either with equations or a signal-based approach (block-diagrams), or with a physical approach like in the Modelica world,” he explains. “And we want to stay longer in the game, with hardware-in-loop testing and software-in-the-loop testing—the kind of technologies that are safety-critical with autonomous vehicles.”

Near- and far-field electromagnetic antenna radiation patterns, simulating signal transmit/receive functions for a connected vehicle are pictured. Image courtesy of ANSYS.

Near- and far-field electromagnetic antenna radiation patterns, simulating signal transmit/receive functions for a connected vehicle are pictured. Image courtesy of ANSYS.Although the number of possible scenarios to be evaluated on such vehicles is huge, Hoffmann observes: “In simulation you can do a lot more than with actual testing. What’s important is that, depending on the answers you’re looking for, you can configure your simulation and easily assemble models with different types of fidelity. Activate is really central for us, so people can use this as a system simulation and integration platform, and integrate various models with various complexities.” In addition, two things that customers like are being able to bring in legacy Simulink (MathWorks) models plus Altair’s support of the Functional Mock-Up Interface (FMI)—the emerging standard for exchanging FMUs from different simulation environments (see “The Functional Mock-up Interface” sidebar). “It’s important we provide an open environment to our users, where people can plug in their solution, using their preferred products,” he says.

ANSYS also sees the big push to merge component and system simulations covering multiple domains and multiple physics, especially for autonomous vehicles. Sandeep Sovani, ANSYS director, global automotive industry, points out the complexity that this entails: “The sensory aspects of the vehicle and the processing aspects of the data, the decisions made and the actions that are taken, are all being done in a split second—therefore there is a need for all these systems to work very closely together as one unit.

“Analogous to that,” he continues, “from a simulation perspective, we need to have the ability to simulate this entire system. For now, different people are developing different things: some companies are working on sensors like radar and LIDAR then the OEMs (original equipment manufacturers) are developing the controller parts of them. Each of these want to simulate what inputs will come to their device, what outputs their device will give and how the rest of the system will change, based on the outputs they are given. That sets up a simulation that is essentially one giant control loop.”

The level of simulation sophistication required for different parts of this platform is quite high. Sovani understands that the OEMs will not be developing this process from scratch but rather using commercial, off-the-shelf tools. This means the simulation vendors have an important role in creating the platform with the guidance of the OEMs. “This is such a large, complex field,” he says, “that I envision there will be multiple players involved, with mixed tools for simulation of radar, simulation of drive-by-wire, and simulation of vehicle dynamics. The platform will need to make these disparate tools work together seamlessly (especially) for autonomous vehicles.”

Where are we now? Sovani says the industry is seeing the need for such a platform, and though the technology is at the very early stage, it is maturing very quickly. He notes that Ford has announced plans to introduce SAE Level 4 autonomous cars, in which the driver has hands off the wheel and eyes off the road most of the time, by 2022.

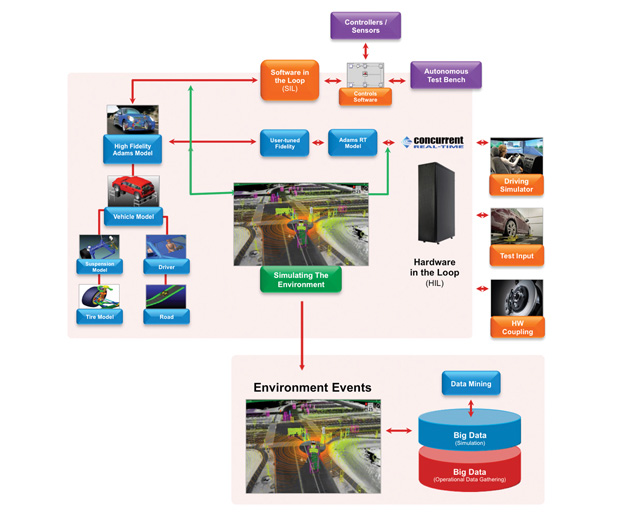

Predict and Validate Fast

As vehicle functions have progressed from basic mechatronics to advanced driver-assistance to some fully autonomous operations, MSC Software products have also been keeping pace. For decades, OEMs and Tier One companies have been using the company’s modeling and simulation capabilities for high-fidelity, off-line analyses of components and systems, handling structural analysis, noise and vibration, complex multi-body dynamics and more. “Time wise, it didn’t matter if it took an hour or two to simulate a roll-over event or hitting a pothole. However, the move to autonomous vehicle design now requires a move to real-time processing,” says Dominic Gallello, MSC Software CEO.

“What we’ve done for selected customers,” explains Gallello, “is run our solvers on a different compute engine, on a real-time operating system. Developers don’t want a reduced-order model to test against hardware—they want one continuous flow from a high-fidelity model to a model that can run in real time. This allows you to connect the virtual models to the physical hardware and validate them.”

Autonomous vehicle virtual process workflows can be handled by software products from MSC Software. Image courtesy of MSC Software.

Autonomous vehicle virtual process workflows can be handled by software products from MSC Software. Image courtesy of MSC Software.The second change Gallello observes is the explosion of data. “We have customers that run tens of thousands of simulations a month off-line of just the vehicle,” he says. “But with event simulation, the amount of decision-making is monumental.” (As in, what to do when the autonomous car sees a police car vs. a school bus.)

Gallello notes that MSC Software already has SimManager, a highly scalable, web-based simulation data and process management system, but he adds that it is going to have to handle many more orders of magnitude of data in capacity; putting data in, doing pattern recognition and getting it out is the go-forward task. MSC Software’s strategy for this is to support connectivity, openness and emerging standards. The company has always connected natively with Simulink models, but for almost three years has also supported working with FMUs and is using them to bring data into their real-time operating system.

Through internal R&D and strategic acquisitions, Siemens PLM Software has also been building a portfolio of solutions that now address every step of smart-vehicle development. Ravi Shankar, director, Global Simulation Product Marketing at Siemens PLM, acknowledges a number of requirements that have led to the company’s emphasis on highly connected, systems-level engineering: Capture and re-use of parameters from the earliest, top-level design simulations; integration of 1D system models with 3D mechanical models with control systems; collaboration across teams and suppliers; and the ability to manage design and simulation data across the product lifecycle.

All of these needs are shaping Siemens PLM Software products in support of predictive engineering analytics. The company is applying multi-discipline simulation and test, combined with intelligent reporting and data analytics, to develop digital twins that can predict the behavior of components and systems across all performance attributes throughout a product lifecycle. Its Simcenter portfolio now includes model-based LMS Imagine.Lab products, a number of 3D simulation/test capabilities such as Simcenter 3D, NX Nastran, STAR-CCM+ and LMS Virtual.Lab, the LMS testing suite, Teamcenter simulation and data process-management, and HEEDS automated design-exploration tools.

Shankar says Siemens PLM Software also supports collaboration among OEMs, Tier Ones and Tier Twos in multiple ways, with support for model-based simulations as key. “For example, Simcenter supports FMI, exporting submodels to the FMU and importing FMUs as external models for co-simulation,” he explains. “On the 3D-simulation side, we offer a unique approach to the creation of finite element assemblies, which allows a distributed team to work independently while making it easy to integrate the various component models into an overall assembly.” He adds that black-box approaches can be supported if details of sub-systems are to be kept proprietary.

Altair’s Hoffmann neatly sums up the situation for today’s automotive simulation work: “Tier One suppliers, and even Tier Two, are extremely skilled and doing as much simulation as the OEMs. What people would like is to have a continuum, where they can easily go from models that are abstract to refined to more detailed. Breaking down the silos between the different disciplines—these will be the challenges.”

More Info

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Pamela Waterman worked as Digital Engineering’s contributing editor for two decades. Contact her via .(JavaScript must be enabled to view this email address).

Follow DE