Subscription Pricing Meets the Design World

The desire for increased flexibility and an ongoing relationship with vendors is fueling a shift toward subscription-based pricing models.

One benefit to subscription- or maintenance-based pricing is easy access to additional functionality such as the web-based CorelDRAW app available to CorelDRAW Graphics Suite users. Image courtesy of Corel.

Latest News

September 1, 2019

Despite engineers’ penchant for consistency regarding their core design tools, there have been a handful of tectonic shifts these last few years. Among the more prominent is the ongoing transition away from traditional licensing models to subscription pricing, which is sometimes accompanied by cloud deployment.

Subscription pricing is fast becoming the de facto standard for many enterprise applications, most notably customer relationship management, HR-related platforms and various collaboration tools. Market research firm Gartner predicts that by 2020, all new software providers and 80% of existing vendors will offer some flavor of subscription-based business models regardless of whether the application is deployed on-premises or in the cloud.

Consumers of software and other products are leaning in to subscription-based pricing models for varied reasons. Some favor a move away from big, upfront capital expenditures (CapEx) to a more consistent and manageable operating cost (OpEx) model. Others are taken in by the flexibility of a subscription model, specifically the ability to scale up software licenses to meet seasonal demands or to accommodate temporary contract workers during peak periods and to dial back licenses when they are no longer needed.

Beyond those apparent upsides, a growing number of customers are pushing for subscription-based pricing models for software and other types of goods because there is now an interest in buying services, not physical products, contends Gian Paolo Bassi, CEO of Dassault Systèmes’ SolidWorks. At the same time, companies are placing a priority on outsourcing key activities to a set of partners that can deliver in a continuous value stream, he adds.

“Switching from perpetual licenses to subscription pricing is not what customers are talking about—the topic of conversation is about helping them be more innovative through a continuous relationship that keeps them current with the latest technology trends, provides updates and delivers best practices,” he explains. “More and more customers are asking us to provide expertise and knowledge that is conducive to a continuous value stream. In financial terms, that is subscriptions.”

The New Lineup

In the CAD community, Autodesk was a pioneer of subscription pricing, embracing the model in a big way nearly a decade ago and underscoring its commitment through its Fusion 360 portfolio of cloud-based CAD/CAM/CAE offerings sold exclusively through subscription. The company has been refining and iterating the model over the last nine years and is seeing a clear preference among its existing and new customer base for subscription pricing even for its non-cloud applications, according to Amy Bunszel, Autodesk’s senior vice president of design and creation products.

Bunszel says Autodesk’s perpetual license, offered with a maintenance option that allows for staying current on software upgrades, is a stepping stone for customers to acclimate to the subscription model and has been essential for driving the transition. Currently, Autodesk derives less than 20% of its revenue from legacy perpetual licenses with a maintenance add-on, and on average, one-third of its maintenance renewal opportunities migrate to a subscription model every quarter, Autodesk officials say. Autodesk also continues to offer a perpetual license with maintenance as a hybrid solution for those customers who are still balking at a full-blown subscription arrangement.

“We took a very deliberate, multi-year approach moving people into subscription,” Bunszel says. “We wanted customers to have advanced notice that changes were coming and we gave them a long runway to plan for when we wouldn’t be selling any more enterprise licenses.”

To accelerate the transition, Autodesk has a number of efforts underway to incentivize customers to move to subscription-based pricing while also doing its part to allay fears about unexpected costs. To that end, Autodesk offers a variety of tools and guidance to provide transparency into its subscription pricing over a 10-year period. In one such example, the company published its extended renewal pricing guidance through 2028 for customers of the Move to Subscription offer, which specifies no more than a 5% increase in 2021, 2023, 2025 and 2027 with no changes to the cost during the even years during the same time frame.

Siemens PLM Software is also seeing an increased appetite for subscription-based pricing from its customer base, although there are discrepancies between industries and more specifically, among different size firms, says Grant Rochelle, the company’s vice president of business models and portfolio management. “Industries subject to a rapid rate of change and that are driven more by new product innovation are looking for every edge they can get,” he explains. “We see this as an and, not an or—we are not looking to take people off of perpetual licenses. Through detailed discussions with customers of all sizes, we see some are ready to go now while others need a couple of years or even longer. We will respect that and provide maximum flexibility going forward.”

That flexibility is delivered in the following ways: Any software from a Siemens acquisition or any newly-developed internal application will now be offered through subscription as the de facto pricing model. In addition, most of the Siemens portfolio is already available as subscription in addition to traditional perpetual licenses, including Solid Edge, NX, MindSphere, Polarion, Teamcenter, Simcenter and Tecnomatix. Niche solutions like Analog Mixed Signal, Catapult, Calibre, Pads, IES Embedded, FLoEFD, FloMASTER and Camstar, among others, can also be served up in a subscription flavor.

In addition to the subscription pricing option, Siemens is offering its software in various ways for added flexibility—for example, NX Cloud Connected products, featured on the Siemens store, can be purchased and run as a flexible cloud-based subscription, including automatic updates. Siemens also has a managed services offering, which is available through perpetual license, but is owned and maintained in someone else’s infrastructure. Going forward, the company is considering enhancing subscriptions by breaking capabilities down into microservices (for example, paying for data storage) as well as a consumption-based model for greater flexibility and customization, Rochelle says.

At Dassault, 92% of existing SolidWorks on perpetual licenses also pay for an additional maintenance layer, which, Bassi claims, is fairly similar to subscription pricing. Customers can choose the traditional SolidWorks desktop offering through perpetual license with or without maintenance, can purchase a term option, which delivers the desktop version on subscription, or can buy SolidWorks in the cloud, which by definition is a subscription offering, he explains. Dassault is looking to evolve its subscriptions with new capabilities like allowing an initiation fee to be paid upfront (Bassi likened it to paying points on a mortgage) to lower monthly costs in addition to a token-based model, which would charge users based on consumption. Dassault’s SIMULIA simulation suite is already offered with a token-based subscription pricing scheme.

PTC, which as of January 1, 2019 no longer offers perpetual licenses for new software sales (with the exception of Kepware), still supports the model if existing customers don’t want to make the break, says Bruce Reed, senior vice president pricing and licensing. As of now, the company has done 1,300 transitions away from perpetual licenses to subscription, and new license sales are in the neighborhood of 95% subscription-based as of the end of this year, Reed says.

Yet Reed cautions companies not to confuse subscription pricing with cloud or software as a service (SaaS) deployment—they can be, but are not always, one and the same. “There is as much on-premises subscription going on as there are SaaS subscriptions,” he says. “CAD customers are not pushing that fast [to go to SaaS]. The issues around data management, file transfer and the graphics nature of CAD packages suggest that sometimes it’s better done locally at the desktop.”

Pros and Cons

One of the less talked about upsides to software by subscription is gaining access to additional products and capabilities not available under traditional licenses. In addition, the subscription model makes it easy for customers to run pilots and experiment with new software without buying additional expensive licenses.

Subscription also transfers risk to the vendor, some contend, as it’s incumbent on the software provider to continuously prove its value by releasing new capabilities designed to keep users engaged. At Corel, for example, users on subscription for CorelDraw Technical Suite recently gained access to a new web-based app that lets them access work remotely.

“Having an ongoing relationship between the software vendor and the user enables us to provide additional functionality that would be difficult to do if it were a one-off transaction,” notes Gérard Métrailler, Corel’s executive vice president of global products. “It helps keep the customer base engaged and adds pressure on software vendors to continue to add value to customers every renewal cycle.”

For Autodesk, subscriptions allow it to offer customers easy access to pilot new capabilities and in the future, better access to analytics that will help administrators optimize their investments and understand how the software is used internally. “There is a foundation of trust that we will use their data responsibly to deliver value back to them,” Bunszel says.

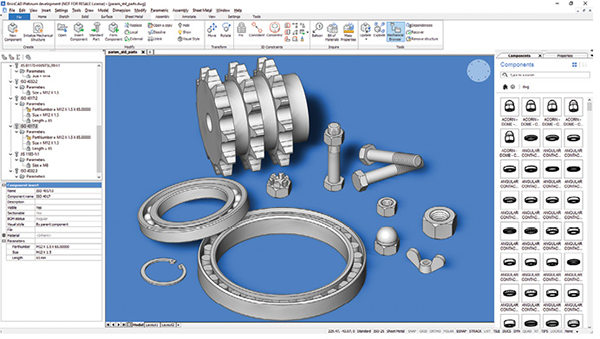

In the end, however, there are just some engineers and design tool users that aren’t interested in making the leap from perpetual licenses to subscription. Bricsys, maker of BricsCAD, offers both options, but claims it’s winning lots of new business simply because of its perpetual option, which still constitutes 95% of its licensing sales today.

“Among small- to medium-size businesses, there is still a great demand for perpetual licenses,” says Don Strimbu Jr., Bricsys’ vice president of communications. “If they have burst needs or are working on specific short-term things, they may use subscription, but customers are coming to us expressly to buy perpetual licenses and they are happy.”

More Autodesk Coverage

More Bricsys Coverage

More Dassault Systemes Coverage

More PTC Coverage

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Beth Stackpole is a contributing editor to Digital Engineering. Send e-mail about this article to [email protected].

Follow DE