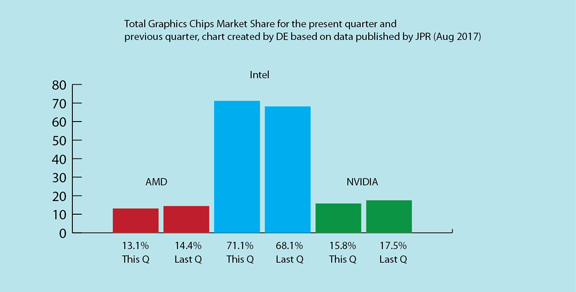

GPU market share changes from last quarter to this quarter, based on data from JPR

Latest News

August 25, 2017

Jon Peddie Research (JPR), an analyst firm that keeps a close tab on the graphics industry, has just released a new report on the GPU (graphics processing unit) market.

“Year-to-year total GPU shipments increased 6.4%, desktop graphics increased 5%, notebooks increased 7%,” according to JPR.

On the three leading microprocessor vendors’ tug of war for market share, JPR pointed out, “AMD’s overall unit shipments increased 7.81% quarter-to-quarter, Intel’s total shipments increased 6.31% from last quarter, and NVIDIA’s increased 10.42%.”

The report’s chart shows that, for the current quarter, Intel owns 71.1% of the market, NVIDIA 15.8%, and AMD 13.1%.

Most people associate Intel with CPUs, not GPUs. So why does Intel claim the lion’s share of the GPU market here? It has to do with Intel’s integrated graphics—graphics processing units built into its chipsets.

GPU market share distribution for this quarter, based on data from JPR

GPU market share distribution for this quarter, based on data from JPRIntegrated Graphics in the GPU Market

Discrete GPUs—the independent graphics-processing boards that gamers, digital artists, and professional engineers rely on to run graphics-heavy software programs—are the territory of AMD and NVIDIA. But CPU giant Intel has also begun adding integrated graphics into its CPUs. Since Intel CPUs are the dominant processors in the PC market, the company accounts for a large share of the GPU tally in this report.

For the roundup, JPR counts graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs). “At least one and often two GPUs are present in every PC shipped,” JPR pointed out. “It can take the form of a discrete chip, a GPU integrated in the chipset, or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to 1.36 GPUs per PC.”

In the discrete GPU market, however, the contest is strictly between NVIDIA and AMD.

GPU market share changes from last quarter to this quarter, based on data from JPR

GPU market share changes from last quarter to this quarter, based on data from JPRBitcoin Gold Rush Boosts GPU Sales

How do digital currencies like Bitcoin and Litcoin affect the GPU market? Enough to warrant some explanations in JPR’s report. “The big difference is the impact Bitcoin, Ethereum, and other coin miners are having on the market,” JPR wrote. “As long as Bitcoin processes keep going up, new people will be attracted to the mining market. It will eventually flatten out because the ROI just won’t be there. At that point AIB (advanced internet blocks) sales for mining will roll off, and we may even see some dumping by the marginal players/miners.”

“With Bitcoin, miners use special software to solve math problems and are issued a certain number of bitcoins in exchange. This provides a smart way to issue the currency and also creates an incentive for more people to mine,” according to Bitcoinmining.com.

Up in One Place, Down in Another

“Overall GPU shipments increased 7.2% from last quarter,” the report stated. It also noted, “Total discrete GPUs (desktop and notebook) shipments for the industry decreased -25.5% from the last quarter, and decreased -6.0% from last year”

JPR president Jon Peddie explained, “Overall discrete GPUs declined due to notebooks; the desktop segment actually increased (due to digital currency mining).”

The report highlighted the following:

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 146%, which was up 9.57% from last quarter.

- Discrete GPUs were in 35.38% of PCs, which is up 4.02%.

- The overall PC market increase 0.12% quarter-to-quarter, and decrease -3.98% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs increased 30.88% from last quarter.

- Q2’17 saw a decrease in tablet shipments from last quarter.

AI, VR, and AR in the GPU Landscape

Initially marketed as graphics accelerators, the GPUs remains indispensable to those in the gaming, digital content creation, and media and entertainment (M&E) markets. But more recently, due to their parallel processing capacity and architecture improvements, they also become part of the high performance computing (HPC) market, serving researchers, AI developers, and simulation software users. Intel, NVIDIA, and AMD are all aggressively pursuing sales in the compute-intensive AI sector.

“AI and deep learning are contributing slightly to the discrete GPU market growth,” said Peddie. But figuring out their impact is a bit tricky due to the way the products are marketed, packaged, or used.

“If NVIDIA sells its preferred AI product, Tesla add-in boards, then we do not count them as GPU sales (even though they have GPUs in them). They are referred to as headless boards. AMD has a similar product, the Vega Inspiration. However, if someone took a workstation add-in board (such as NVIDIA Quadro or AMD FirePro) and used it to do AI and deep learning (and maybe even neural network), then we would count it. The same is true for consumer add-in boards (NVIDIA GTX and AMD Radeon),” he explained.

For more on the report, go to JPR.

JPR publishes a separate report for add-in boards.

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Kenneth Wong is Digital Engineering’s resident blogger and senior editor. Email him at [email protected] or share your thoughts on this article at digitaleng.news/facebook.

Follow DE