Mass Customization’s Data Challenge

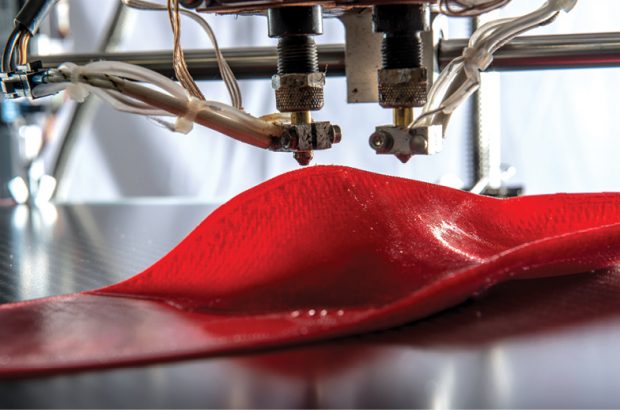

Adidas is leveraging Carbon’s Digital Light Synthesis 3D printing technology to mass produce custom, high-performance sneakers. Image courtesy of Carbon.

March 1, 2018

Having a pair of custom-designed ski boots and inserts is a dream come true for an avid skier. Ill-fitting gear detracts from comfort and performance, yet the industry has struggled to come up with a mass customization method that is affordable and practical for the ski boot manufacturer as well as for retailers and consumers.

Thanks to additive manufacturing and advanced 3D scanning, Tailored Fits, a Swiss manufacturer, is making fast tracks toward a solution. The company partnered with Materialise to create a digital customization platform for wearables that can turn around orders for custom inserts along with fully customized ski boots in just 10 days. Although advances in 3D printing and 3D scanning have made the new gear possible, it was the pair’s collaboration around digital workflow and design automation software and processes that allowed Tailored Fits to cost effectively offer a mass customized product, says Reto Rindlisbacher, CEO of the firm.

Tailored Fits has tapped Materialise technology and expertise to create a customization platform and digital supply chain for 3D printed ski boots and inserts. Image courtesy of Materialise.

Tailored Fits has tapped Materialise technology and expertise to create a customization platform and digital supply chain for 3D printed ski boots and inserts. Image courtesy of Materialise.“A total digital workflow is important because when you’re working with 3D data, you create a significant amount of work that you want to avoid,” Rindlisbacher explains. “We want to be able to get product to market fast and we don’t want to spend a lot of money setting up a large crew to prepare data for 3D printing. It’s important from the beginning to have a smooth process.”

Degrees of Design Freedom

Mass customization, a holy grail for manufacturers across many industries, has had a difficult run given a range of obstacles, from inadequate materials and still immature 3D printing practices to challenges related to integrating all the critical data sources to drive production of a customized product. Advances in 3D printing materials and technology have launched the practice from a small segment of companies in specific industries like medical instruments and dental fixtures to a growing number of pilot deployments in mainstream retail and consumer sectors, including customized footwear, eyeglasses and even a new generation of personalized vehicles.

“There’s increased interest in mass customization because the desire and pull from designers at product companies has always been there, but now 3D manufacturing practices have matured to where there’s the right push from advances like speed and surface finish resolution,” says Gurjeev Chadha, technical product marketing expert at Carbon. Carbon’s 3D printers are based on an additive manufacturing process called CLIP (Continuous Liquid Interface Production), which harnesses light and oxygen to produce products from resin while addressing some of the resolution and surface finishing shortcomings of conventional 3D printing technologies.

Key to making mass customization a reality for manufacturers is creating the digital platforms and accompanying processes that establish a digital thread connecting relevant data about an individual consumer with different product variations and ultimately serving it up in a format that can drive the 3D printing process. Currently, most of these early digital platforms are built around custom software and company-specific data transformation, integration and automated workflow processes designed collaboratively by the manufacturer and its 3D printing partners as opposed to implementation of off-the-shelf software and solutions.

Also essential to the mix are new data acquisition tools and data sources that can drive the mass customization, regardless of product type. “To get there, it’s all about data sources,” explains David Tucker, market development manager, 3D printing at HP, which is touting its Jet Fusion 3D 4200 printers as a path to industrial 3D manufacturing and mass customization. “We need to figure out the sources of data we can exploit—whether they exist or whether we need to invest in them. We also need to incorporate additional data acquisition tools, otherwise you are simply presenting customized products with limited options.”

HP Jet Fusion 3D 4200 printers create a path to industrial 3D manufacturing and mass customization. Image courtesy of HP.

HP Jet Fusion 3D 4200 printers create a path to industrial 3D manufacturing and mass customization. Image courtesy of HP.As part of its vision, Carbon is touting a full portfolio of specialized software that facilitates on-demand 3D manufacturing, including algorithmic design tools to help designers easily create internal lattice structures, and its SpeedCell platform that supports fleet management of multiple printers so manufacturers can produce customized products at scale.

In one of its most prominent customer examples, Carbon is working with footwear giant adidas, initially on Futurecraft 4D, a mass production process that can churn out previously impossible midsole designs with 3D printed materials and will eventually pave the way for custom, high-performance shoes that meet the unique needs of customers. Key to the adidas effort is lattice simulation and FEA automated support tools, which allow for design freedom to produce shoes with variable properties throughout the midsole, cutting back on trial and error. The software was a collaborative design effort between Carbon and adidas, and is now offered as a commercial product for customers working with Carbon technical partners.

adidas is leveraging Carbon’s Digital Light Synthesis 3D printing technology to mass produce custom, high-performance sneakers. Image courtesy of Carbon.

adidas is leveraging Carbon’s Digital Light Synthesis 3D printing technology to mass produce custom, high-performance sneakers. Image courtesy of Carbon.“With mass customization, you want efficiencies—you need the first sole out of the printer to be accurate otherwise, there are serious doubts that the business model can work,” Chadha explains. “These tools unlock the ability to design and manufacture midsoles right the first time, but also to create lattice structures or materials where the simulation behavior matches the mechanical behavior.”

Collaborative Design

As the Carbon/adidas partnership illustrates, much of the software driving mass customization and data integration workflows is currently highly customized itself, born from collaborative efforts between the individual manufacturers and their key 3D printing partners. There is a lot of activity in the footwear sector. In addition to the Carbon/adidas collaboration, Under Armour last November announced a strategic partnership with EOS to leverage its advanced laser sintering technology for printing powder-based parts and evolving polymer powder development, and Nike’s NIKEiD, available on its website and in select stores, lets customers tailor the more aesthetic parts of design like color, text, collar and lacing. Even the automotive industry is getting in on the act: European car company Opel offers an almost unheard of level of customization (4 billion combinations) on its ADAM and ADAM ROCKS models, thanks to a manufacturing concept that adapts material and production flow based on customer requirements.

The medical industry has been way out in front on mass customization practices, particularly for surgical cutting guides, which are well established for producing far better outcomes for patients, reducing costs and making much better use of surgeons’ time, according to Laura Gilmour, global medical business development manager of EOS North America. EOS works with a variety of customers in this space on customized software and workflows that enable them to quickly churn out patient-specific instruments—in the case of Smith & Nephew, 650 unique cutting guides per week. An MRI or CT scan is used to create a virtual model of a patient’s anatomy that engineers and surgeons use to preplan the surgery along with the sizing and placement of implants and a subsequent design for a disposable surgical instrument matched specifically to the patient’s anatomy.

EOS technology lets Exactech create medical instruments in small production runs with reduced lead times and costs. Image courtesy of Exactech.

EOS technology lets Exactech create medical instruments in small production runs with reduced lead times and costs. Image courtesy of Exactech.Although the medical industry has a lot of the mass customization processes down, there are remaining challenges, many related to data. Specifically, ensuring that the patient data tracked with digital design data all the way through the process is kept in compliance with patient privacy regulations like HIPAA (Health Insurance Portability and Accountability Act). The data also is used to ensure product quality, certification and qualification.

“Generally speaking, most product customizations to date are variations on base designs, allowing for a range of flexibility while still maintaining the integrity of the product,” notes Dr. Greg Hayes, director of applications and consulting for EOS North America. “Software design programs together with trained users can identify design for manufacturing improvements and help ensure quality.”

HOYA Vision Care set out to shake up the eyewear industry with a mass customization strategy co-developed with its partner, Materialise. It starts with the Yuniku 3D scanning system and kiosk designed for use in optician shops to take high-resolution scans (they register within 1/10 mm accuracy) of a customer’s facial anatomy. Unlike conventional eyewear design, which restricts lens performance because opticians must match lens placement to the chosen frame, the Yuniku platform leverages tools like 3D scanning, parametric design automation and 3D printing, to design the frame around the ideal position of the optical lens on an individual’s face.

HOYA has launched Yuniku, a 3D scanning system that aids in the production of custom eyewear. Image courtesy of HOYA Vision Care.

HOYA has launched Yuniku, a 3D scanning system that aids in the production of custom eyewear. Image courtesy of HOYA Vision Care.HOYA-designed software parses facial and visual data to determine the ideal placement of the lenses in relation to the eyes, while Materialise’s software is used to modify the frame appropriately based on those parameters and the individual’s unique characteristics. Consumers can also select color and finish, and once the design is complete, it is sent off to the HOYA factory for 3D printing and some additional manual finishing work, according to Felix Espana, HOYA’s global new media manager. Currently, HOYA has about 200 Yuniku operational platforms, mostly in Europe.

Hearing aid manufacturer Sonova USA transformed its technology and workflow processes more than 15 years ago to support the mass customization model. “By definition, what we do is mass customization—every ear is different, every hearing loss is different, the complexity is widespread and we have to customize for individual patients,” explains Mujo Bogaljevic, the company’s vice president of operations.

With its partners, including 3D printer maker EnvisionTEC, Sonova custom-designed software and brought in hardware specifically mapped to support its data-driven processes. There are 3D scanners, which capture 30,000 data points in 30 seconds and scan silicone impressions of patient ears to create digital files. There is a custom-built design program, the Rapid Shell Manufacturing Design software, which marries the 3D image with patient and order data stored in SAP or other business systems, including key information such as preferences for size, color and options along with more clinical information about the patient’s hearing loss. The software, which was designed for use by operators who are non-CAD users, also directs placement of all the electronics and other components required for the hearing aid.

“The software performs the collision detection and knows what can be produced and what can’t,” Bogaljevic explains. “It’s a combination of automated CAD design software with the ability to modify as necessary by the operator using their experience.”

Also developed in-house by Sonova, is its Digital Work Order Management (DWOM) application, which is the connective tissue that integrates the relevant data from the different databases and helps automate the workflow, including pushing orders to the EnvisionTEC 3D printers, without requiring operator intervention.

This piece of the puzzle is critical if manufacturers are serious about making the leap from 3D printing for rapid prototyping to a full-scale mass customization process. Says Bogaljevic: “This is a fully integrated, mass customization environment so we had to tie everything together; if we were passing data off manually, it would be very inefficient.”

Subscribe to our FREE magazine, FREE email newsletters or both!

About the Author

Beth Stackpole is a contributing editor to Digital Engineering. Send e-mail about this article to [email protected].

Follow DE