BMW’s Additive Manufacturing Campus will focus on both production and prototype parts. Image courtesy of BMW.

Latest News

July 10, 2020

Earlier this year, Westinghouse Electric Company reported that it had installed a 3D-printed thimble plugging device in the Exelon Byron Unit 1 nuclear plant, reportedly a first-of-its-kind installation in the energy industry.

“Additive manufacturing is an exciting new solution for the nuclear industry,” says Ken Petersen, Exelon Generation's vice president of nuclear fuels. “The simplified approach helps meet the industry's need for a wide variety of low-volume, highly critical plant components. We are proud to have Westinghouse as a partner on this industry milestone and to help further demonstrate the viability of this technology.”

Westinghouse has installed a 3D-printed part in a nuclear power plant. Image courtesy of Westinghouse.

As this was a new application, Westinghouse created Stainless-Steel Alloy 316L and Inconel Alloy A718 specimens for testing. According to the company, the alloys were well suited for nuclear applications.

While this was just the latest example of an additively manufactured production part, it was certainly not the only one. In May, General Atomics Aeronautical Systems (GA-ASI) completed the first test flight of a 3D-printed part inside one of its remotely piloted aircraft. This is significant, as producing aeronautical-grade AM parts remains a major challenge in the industry. The company teamed with GE Additive AddWorks on metal laser powder bed fusion (LPBF) development. Eight months later, they tested a metal printed NACA inlet made of Titanium on the SkyGuardian RPA.

The printed part is lighter and less expensive compared to the three-component part it replaces (which required tooling and welding, in addition to inspection). GA-ASI has also partnered with Australia's Conflux Technology to develop an additively manufactured heat exchanger.

GA-ASI’s SkyGuardian RPA takes to the sky. Image courtesy of GA-ASI, GEADPR036.

Current events have also pushed additive manufacturing to the fore, as companies struggled to adjust production in a world where borders were closed, employees labored at home instead of the office, and many factories and warehouses were either shuttered or forced to operate with a skeleton crew.

In the health care space in particular, where there were shortages of personal protective gear like face shields, as well as important ventilator components, 3D printing companies and other manufacturers with the equipment on hand soon found themselves churning out medical equipment to meet local demand. That served to highlight additive manufacturing’s value as an important tool in providing supply chain responsiveness and flexibility.

Software Improves Reliability

Still, additive manufacturing of production parts is not widespread outside of certain industries. The technology has traditionally been used for prototyping, but that is beginning to change.

A 2017 study from Jabil found that while 81% of manufacturing companies said they were using 3D printing, just 29% were using it for production parts. But 93% of respondents expected to increase their use of 3D printing for production parts within the next 5 years.

The expansion of available materials will help prod this evolution along, as will falling costs and improvements in speed, as well as part reliability and accuracy. 3D printers have struggled with consistency—many early adopters like GE found that part quality could vary significantly across the same model printer producing the same part, and even with prints generated by a single machine over time. Quality could be influenced by temperature, machine run times and operator habits.

“By some estimates, it takes companies five or more attempts to 3D print a qualified part from their additive manufacturing design models,” says Aaron Frankel, vice president of the additive manufacturing software program for Siemens Digital Industries Software. “This high failure rate not only compromises the economic feasibility of additive, but it also thwarts efforts to employ the technology in high-volume production. This is particularly true of 3D metal printing.”

Many of these quality issues have been addressed by calibrating the machines to accommodate how the printer and the materials are affected by time and temperature; improved simulation technology; and in situ monitoring solutions that can adjust machine performance during a production run.

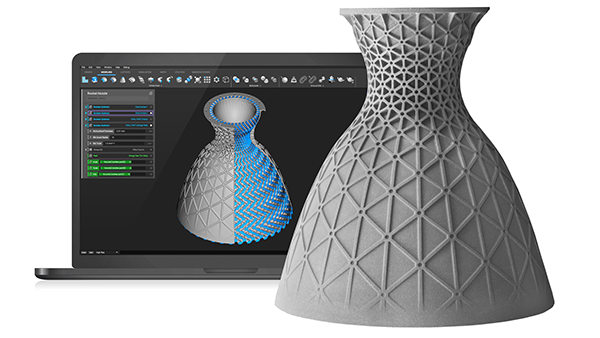

However, calibration can only go so far. While performance of additive hardware has improved significantly in recent years, software performance and file formats have remained clearly stuck in the past. The continued use of outdated software and the STL file format means that each attempt to qualify a part, as mentioned above, can take hours and even days for build preparation and slicing. If you have to do that multiple times, it can add up to days or even weeks of file processing, and that doesn't even include 3D print times. With that in mind, Dyndrite with support from NVIDIA, has developed a new geometric kernel that leverages GPU computing power, and enables use of mathematically pure CAD data rather than decimated translation data like STL. What this means is that new software developed on the Dyndrite kernel can significantly reduce lengthy processing times –Processes such as slicing that currently can take hours are reduced to a matter of seconds.

Reaching production-grade additive manufacturing requires software automation. By adding a Python API into Dyndrite, engineers and technicians can easily automate complex and tedious parts of the build preparation process. Examples include nesting of parts, custom labeling, and more – which can now be completed at the touch of a button within a few seconds. Dyndrite is already seeing key early success, and recently announced a partnership with HP.

Design for additive manufacturing (DfAM) capabilities and generative design tools are working their way into a number of CAD and simulation tool sets. “The main reason that parts fail is that the design was never optimized for 3D printing,” says Dries Vandecruys, design engineering manager, Materialise. “Something designed for traditional manufacturing with overhangs and without gradual wall thickness, increases the chance of failure tremendously. So first of all, take the specificities of metal 3D printing into consideration when you’re designing your parts.”

ABI Research’s Generative Design Assessment last year included rankings for nine major vendors, including ANSYS, Altair, Autodesk, Dassault Systèmes, GRM Consulting, ParaMatters, PTC, nTopology and Siemens. Many of these companies are also working with 3D printer manufacturers, which have developed their own software solutions to help bridge the gap between CAD and AM.

In 2018, PTC acquired Frustrum, providing generative design capabilities targeted at additive manufacturing for the Creo platform. MSC Software (part of Hexagon) is taking advantage of AM-based design optimization capable from the AMendate acquisition. Autodesk has its own homegrown tools in the Fusion 360 Generative Design offering.

nTopology, with its nTop Platform software, is trying to accelerate design iterations using artificial intelligence routes and generative design to automate the way models can be created to conform to additive manufacturing standards. nTop Platform uses equations to represent a 3D solid directly, in an implicit modeling approach to product development. Each equation represents the distance to a shape from any point in space. By default, raytracing is always on, allowing a realistic view of the product while editing. It was designed to augment existing CAD, CAE and other solutions.

The most recent release of VERICUT V. 9.1 includes verification and optimization tools for simulating additive as well as CNC machining and hybrid operations. The software’s Additive Default Machining Type feature enables VERICUT to predict system resources that will be needed to additively build the as-designed part, including a starting stock build plate or model.

Distortion compensation is another key issue, which some software companies are also addressing.

Simulation software maker Ansys offers the ANSYS Additive Suite, which specifically targets metal AM. Capabilities include thermal simulation, topology optimization, AM process simulation and geometry editing and modification.

“Distortion compensation is one of the top reasons customers use our ANSYS Additive Suite,” says Brent Stucker, director of AM for Ansys. “The method is always machine- and material-specific. What you are doing is figuring out how the geometry will change during the production process, then modifying the geometry to account for that change using an algorithm.”

As part of its distortion calibration, Ansys’ software incorporates machine behaviors provided by 3D printing system makers, and material characteristics from material suppliers. Accurate distortion prediction is facilitated by the simulation software’s ability to digitally recreate the thermochemical changes that occur in the print process, based on the data from hardware and material makers.

A New Approach

Companies like GE understood early on that advancing AM within its own operations would require a different approach. The company now has its own 3D printing subsidiary, as well as a robust research and development operation, which has helped not only expand the use of metal printing within its own manufacturing divisions, but also provided solutions for other companies as well. GE was also one of the first out of the gate with a real production part for aviation—a fuel nozzle printed from nickel alloy for its GE9X engine.

BMW has embraced this approach as well, opening its own Additive Manufacturing Campus in Munich in July, which will produce both prototype and series parts, as well as support research activities.

“Our goal is to industrialize 3D printing methods more and more for automotive production, and to implement new automation concepts in the process chain,” adds Daniel Schäfer, senior vice president for Production Integration and Pilot Plant at the BMW Group. “This will allow us to streamline component manufacturing for series production and speed up development. At the same time, we are collaborating with vehicle development, component production, purchasing and the supplier network, as well as various other areas of the company to systematically integrate the technology and utilize it effectively.”

Last year, BMW produced about 300,000 parts via additive manufacturing. Those include a lot of plastic parts, but also metal functional parts (such as some components on the Rolls-Royce Phantom). The Additive Manufacturing Campus currently employs up to 80 associates and operates about 50 industrial systems that work with metals and plastics. Another 50 systems are in operation at production sites around the world.

Honeywell Aerospace recently announced a partnership with VELO3D to qualify VELO3D’S Sapphire system to producing aircraft components at Honeywell’s Phoenix facility. The companies are focusing on the INCONEL nickel-based alloy for high-temperature applications.

“We are qualifying VELO3D’s Sapphire system with the aim of printing geometries that can’t be fabricated on existing 3D metal printers. Their technology will help Honeywell develop new production-part applications while also meeting our material requirements for qualification,” says Dr. Söeren Wiener, senior director of technology and advanced operations for Honeywell Aerospace.

The growth AM for production parts will not require companies to leverage new technology, simulation and material capabilities. It will also require a more close collaboration between design and manufacturing experts during the creation of any given component.

More Dell Coverage

More NVIDIA Coverage

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News